- Clear Creek Amana CSD

- Public Notice and Financial Information

Business Services

Page Navigation

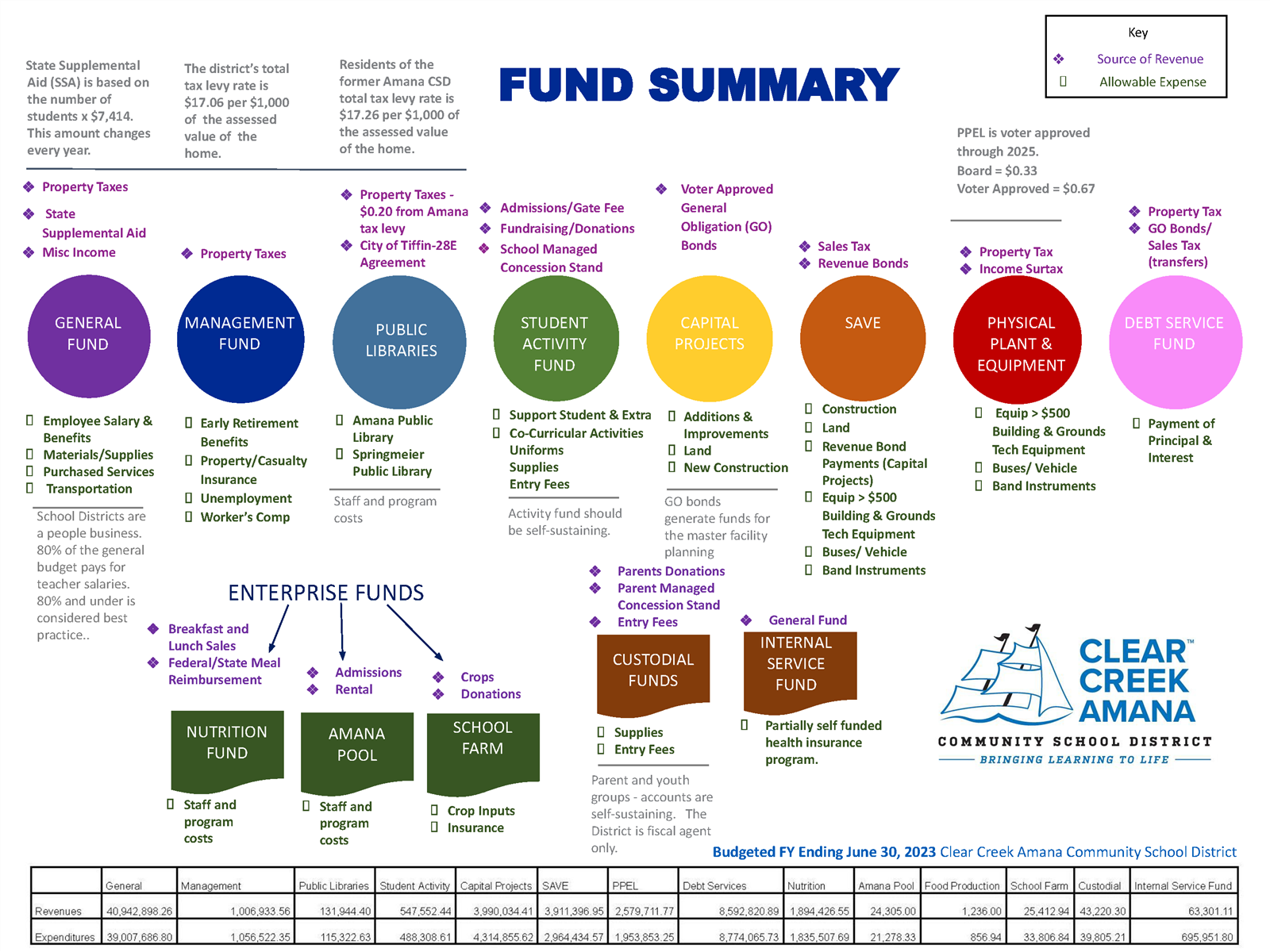

District Financial Information

-

Public Notices

Notice of Public Hearing for Proposed Property Tax Levy

Funding Sources

Business & Finance Staff Directory

- CCA CSD Administration Office

| Showing results for "Professor named Smith at Elementary School" |

- Tami Brenneman

- Sarah Gaeta

- Mary Moser

- Lori Robertson

We weren't able to find anything that matched your search criteria. Please try a new search.